Asset-Based Lending for the Digital Age

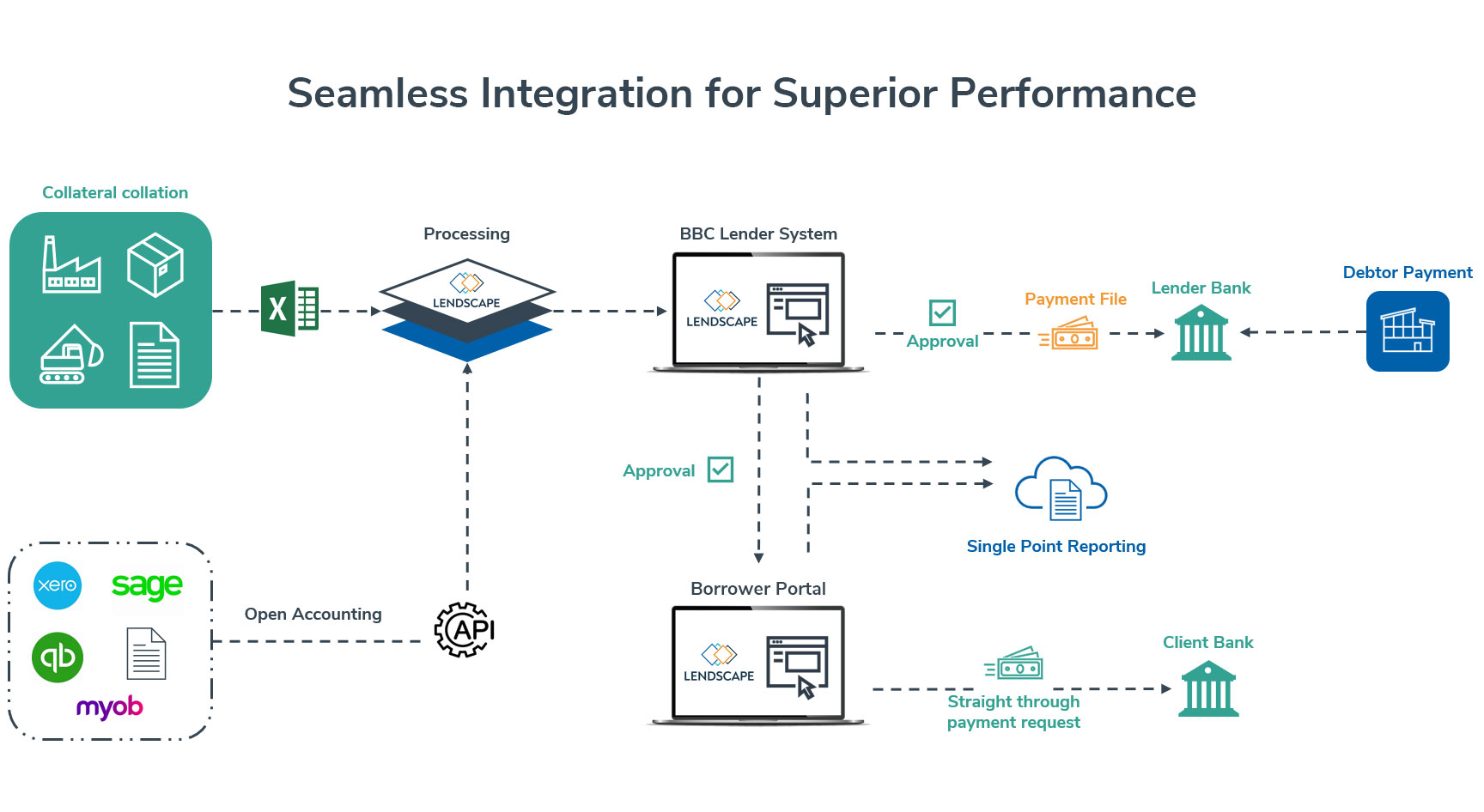

At Lendscape, we understand that efficient and effective lending can transform businesses. That’s why our cutting-edge Asset-Based Lending (ABL) technology is designed to simplify and enhance the lending process, reducing manual input, minimising errors, and saving processing time.

Our platform brings essential innovation to the traditionally manual process of commercial lending, offering a streamlined, comprehensive, and seamless digital experience for both lenders and borrowers - reducing staff workload and lowering costs.

This approach streamlines daily operations, benefiting all parties and empowering finance providers to help build strong, thriving businesses.

"We took the decision to upgrade the core Asset Based Finance platform across our Group – in the Netherlands, Germany, France and the UK. Following extensive consideration, we decided on the Lendscape solution, with the priority to undertake a 9-month project to upgrade our business in the Netherlands. We are pleased with the end result and look forward to our continued partnership with Lendscape, enabling us to take our business forward and further develop our domestic and cross-border Receivables and Asset Based Lending solutions."

Arjan de Liefde, Managing Director Corporate & Institutional Banking

ABN AMRO Asset Based Finance N.V.